Before becoming founder and President at Club degli Investitori, you were a founder/CEO, walk us through your story?

After graduating in engineering, in 1980 I founded Euphon, which become the leading independent operator in the multimedia industry in Italy, with a preeminent position in Europe. In the year 2000, Euphon was listed on the Italian stock exchange and I decided exited Euphon in 2004 to a private equity investor. Then, I have been President of Sviluppo Italia Piemonte, a regional government agency and then appointed President of Piemontech, the first regional government seed-capital fund in Italy. Today I am investing in SMEs and startups as Business Angel and I am the founder and President of Club degli Investitori, one of the most relevant business angel network in Italy.

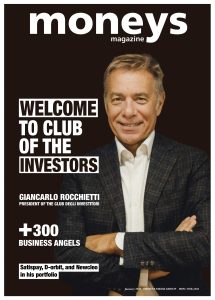

How was the Club degli Investitori founded? How many members does the club consist of?

How was the Club degli Investitori founded? How many members does the club consist of?

I founded Club degli Investitori in 2008 and now it has more than 300 business angels.

The typical Club Member is an entrepreneur, manager or leading professional with relevant experience and international competences.

How do you select the Start up?

When I select a start up, I mainly consider the soft and hard skills of the founding team. As soon as I like the team, I pay attention to the product and the market, to the pre-money evaluation and the quality of the co-investors, if any. At seed o pre-seed level the business model is not the main topic to analyze.

What do you love most about angel investing? What about your work brings you joy?

What do you love most about angel investing? What about your work brings you joy?

Angel inventing is not only making money, it is also having fun. Since I have started this activity I have built a large network of friends, I have met many visionary entrepreneurs, I have improved my knowledge in tech and innovation. Last but not least, I consider myself a lucky person and supporting the entrepreneurs is a give back.

Some years ago you said that, out of 10 entrepreneurs, 4 went under, 4 stayed afloat and 2 performed. Are these numbers still valid? Tell us what makes businesses go under, what makes them perform?

Yes, I confirm that angel investing follows the Pareto principle.

It means that 80% of the performances of an angel investor come from 20% of the investments.

The main cause of start up failures is the low quality of the founding team. The second cause is the low quality of the investors.

Tell us a little about ‘Business Angel of the Year’.

Tell us a little about ‘Business Angel of the Year’.

Business Angel of the Year is the main event in Italy dedicated to angel investing, organized every year by the Club degli Investitori to highlight the work done by investors to support startups and their founders. The jury of the award, composed of leading Italian venture capitalists, this year nominated Mauro Ferrari as ‘Business Angel of the Year 2022’. Previous editions were won by: Paola Bonomo, Fabio Cannavale, Andrea Rota, Enrico Chiapparoli and Antonella Grassigli.

Which of your startups in your portfolio is ready to scale in Europe?

Satispay is starting to expand his payment application in France. Newcleo has already branches in the UK and France to build nuclear reactors. D-orbit is a global aerospace company.

I tend to invest in company with the aim to grow internationally.

Tell us what Europe can do to better support the entrepreneurial ecosystem?

I think that the main way to improve investments in European tech entrepreneurs is to maintain and to improve tax incentives for private investors.

How risky is it to invest in startups? And how much of your assets should you invest?

High risks and (maybe) high rewards. You should invest between 5% and 10 % of your financial asset. Let’s consider also that these are long term and illiquid investments.

What were your greatest achievements either as founder/CEO, or as an investor?

What were your greatest achievements either as founder/CEO, or as an investor?

As I am an entrepreneur I respect and admire passionate and ambitious entrepreneurs who struggle every day to compete in the market.

I am very happy to help them with my experience, network and money.

Doing this job with more than 300 friends (the members of the Club) is very powerful.

What is the next thing?

I am seeing in Europe a growing number of investments in Life sciences, food and energy sectors.

I am not so confident about fintech, Cripto Metaverse, Web 3.

Regarding the technology I believe the next think will be quantum computing.